The market study looks at the worldwide Carbon Credit Trading Platform Market and considers all of the important trends. After reading the research, the user will be able to comprehend and acquire insight into the existing and future market position. To provide comprehensive information on the global condition, the market is thoroughly studied by geography. After reading the study report, the user will be able to comprehend and acquire insight into the existing and future market position. A competitive landscape of main industry players, as well as market development trends, are included in the study.

The qualitative and quantitative data in this study can help customers figure out which market segments, geographies, and driving elements, as well as key prospective areas, are projected to grow quicker. A competitive landscape of leading industry players, as well as emerging market trends, are also included in the report. An in-depth examination of market trends. New trade rules, market size, regional and segment market share, product/service releases, product pipeline analysis, the influence of Covid-19 on key regions, unexplored markets, constant developments, and advancements in the Carbon Credit Trading Platform industry are all discussed in this research.

Get a Sample Report of Carbon Credit Trading Platform Market 2023 @ https://www.snsinsider.com/reports/carbon-credit-trading-platform-market-2794

Key Players included are:

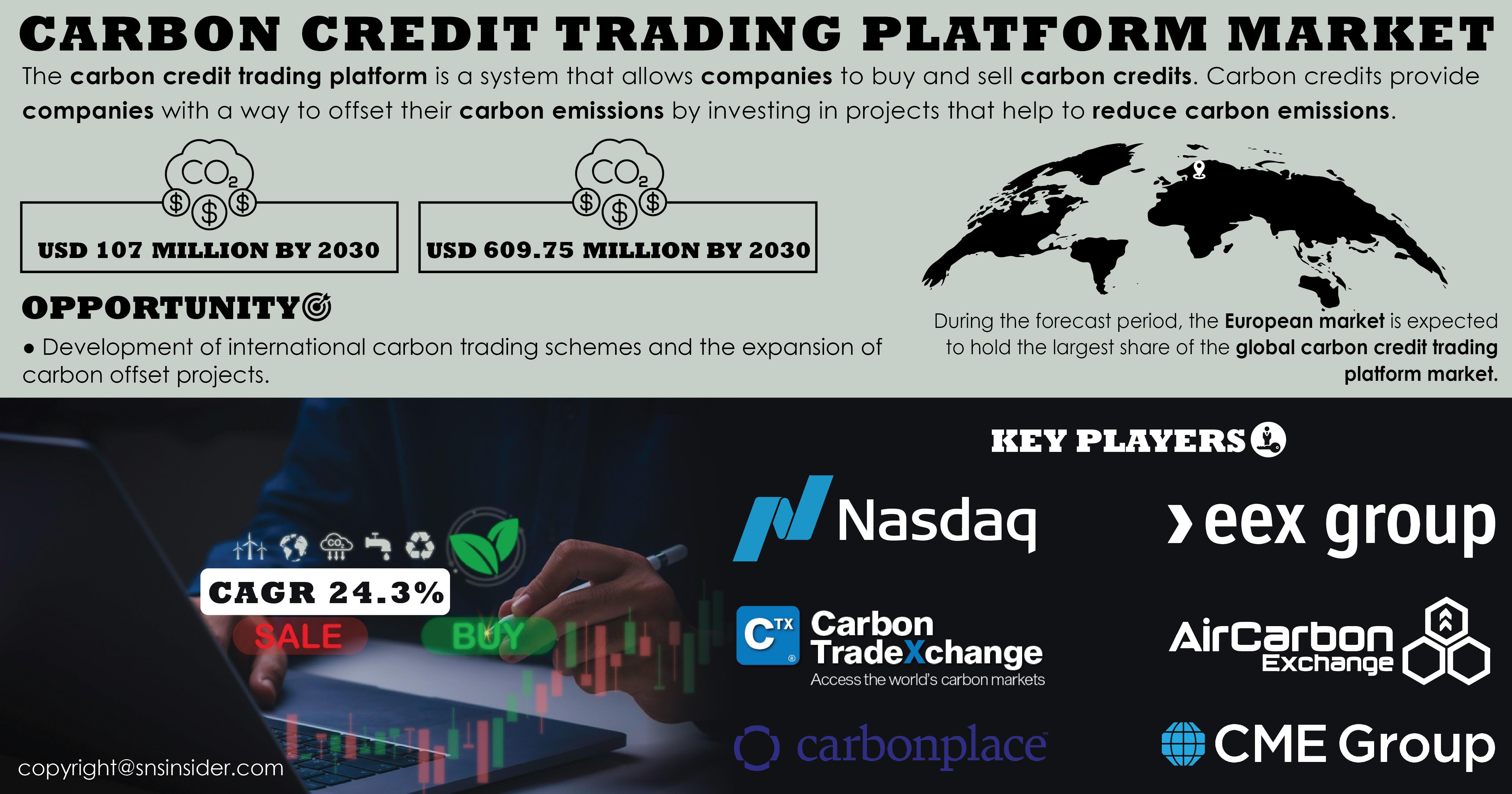

The major key players are Nasdaq, Inc., Eex Group, Carbon Trade Exchange, Air Carbon Exchange (Acx), Carbonplace, CME Group, Xpansiv, Climate Trade, Planetly, Toucan, Carbon Credit Capital., Flowcarbon, Likvidi, Carbonex, Betacarbon, and other key players will be included in the final report.

Market Segmentation

Market research provides precise value and volume estimates, allowing market participants to gain a comprehensive understanding of the whole industry. Market share, consumption, production, market attractiveness, and other relevant factors are used to examine the segments in the study. The Carbon Credit Trading Platform market has been segmented by product type, end-use, and application, according to the report. The experts also looked into a variety of industries where manufacturers could profit in the coming years.

Market Segmentation and Sub-Segmentation included are:

By Type:

- Voluntary Carbon Market

- Regulated Carbon Market

By System Type:

- Cap & Trade

- Baseline & Credit

By End-use:

- Utilities

- Industrial

- Aviation

- Petrochemical

- Energy

- Others

COVID-19 Impact Analysis

This segment of the Carbon Credit Trading Platform market analysis compiles information from throughout the industry to see how people reacted to lockdown. It looks into the effects of the outbreak on industry employees as well as the interruption in different places and countries. Market trends were altered as COVID-19 spread throughout different geographies, according to this section of the study report. This component of the study looks ahead to see how the economy will recover and how the business climate will change.

Competitive Outlook

The product portfolio, business overview, governance, financials, business strategies, manufacturing locations and production facilities, company sale, recent developments and strategic collaborations & partnerships, new product launch, company segments, application diversification, and company strength and weakness analysis are all covered in the Carbon Credit Trading Platform market report.

Reasons to Purchase Market Research Report

- The Carbon Credit Trading Platformmarket study includes a thorough analysis of future trends as well as potential expansion prospects.

- The research report covers market dynamics, revenue analysis, market drivers, and development factors in great depth.

- The market study covers a detailed historical, current, and forecast analysis to acquire a thorough grasp of market dynamics.

Table of Contents – Major Key Points:

- Introduction

- Research Methodology

- Market Dynamics

- Impact Analysis

- COVID-19 Impact Analysis

- Impact of Ukraine- Russia war

- Impact of Ongoing Recession on Major Economies

- Value Chain Analysis

- Porter’s 5 Forces Model

- PEST Analysis

- Carbon Credit Trading Platform Market Segmentation, By Type

- Carbon Credit Trading Platform Market Segmentation, By System Type

- Carbon Credit Trading Platform Market Segmentation, By End-use

- Regional Analysis

- Company Profile

- Competitive Landscape

- Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact US:

Akash Anand

Head of Business Development & Strategy

Ph: +1-415-230-0044 (US)

Email: info@snsinsider.com