Automotive Active Window Display Market Set to Expand to USD 4.2 Billion by 2027 Driven by In-Vehicle Connectivity & Passenger Engagement

Market Size

- Estimated Value (2023): USD 1.9 Billion

- Projected Value (2030): USD 4.2 Billion

- Compound Annual Growth Rate (CAGR): Approximately 11.5% (2024–2030)

Overview

Active window displays—featuring embedded LEDs, electrochromic panels, touchscreen capability, and smart tint technology—offer next-generation vehicle interfaces. They enhance infotainment, passenger comfort, AR navigation, and brand display opportunities. Growth in connected vehicles, increased passenger focus, and vehicle-as-a-service models are driving adoption across luxury and mainstream segments.

To Know More About This Report Request A Free Sample Copy https://www.maximizemarketresearch.com/request-sample/73651/

Market Estimation & Definition

The market includes Transparent OLED, LED matrix, smart glass, and heads-up display (HUD)-integrated windows for automotive applications. Positioned as front- and side-window interfaces, these systems serve dual purposes: advanced interaction for passengers, and accessory tech for vehicle brands and autonomous ride-sharing fleets.

Market Growth Drivers & Opportunities

- Connected Vehicle Evolution: Integration of IoT, AR, and cloud interfaces transforms vehicle windows into dynamic digital portals.

- Passenger-Centric Design: Home-like cabin experiences with streaming, interactive content, and smart comfort controls.

- Autonomous Mobility Vision: In driverless vehicles, windows become key displays for media, navigation, and environmental information.

- Branding & Delivery Spaces: Fleet and vehicle-as-a-service operators use active windows for mobile advertising and passenger cues.

- Smart Glass & Tinting Innovations: Electrochromic and thermochromic glazing promote energy efficiency and privacy, aligning with active displays.

Segmentation Analysis

By Technology Type:

- Transparent AMOLED/OLED

- LED Matrix

- Smart Glass / Electrochromic Displays

- Heads-Up Display (HUD) Integration

By Window Location:

- Front Windshield

- Side Windows

- Rear/Back Windows

By Vehicle Type:

- Passenger Cars (Luxury, Mid-Range)

- Light Commercial Vehicles

- Autonomous & Ride-Sharing Pods

By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Major Manufacturers

Leading suppliers include:

- Continental AG

- Panasonic

- Lumineq (VisionOX)

- Nippon Electric Glass

- Gentex Corporation

- BorgWarner (MEMStops)

- Corning Incorporated

- Velodyne Lidar (integrated HUD systems)

- Novelis

- PPG Industries

- AGC Inc.

- Sekisui Chemical

- Saint-Gobain

- Motherson Sumi Systems

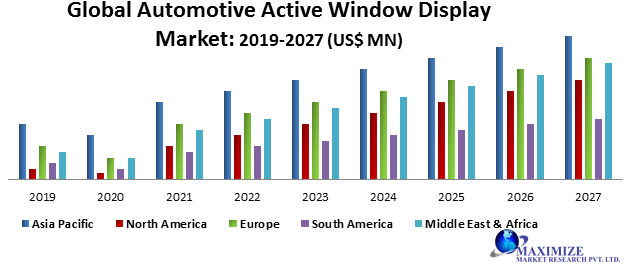

Regional Analysis

North America:

Establishing leadership due to advanced automaker adoption, deep R&D, and high penetration of connected luxury and EV segments.

Europe:

Robust presence shaped by CSR-oriented regulations, consumer preferences for innovative cabin solutions, and strong OEM collaborations.

Asia-Pacific:

Fastest-growing region backed by emerging EV manufacturers, smart glazing production clusters, and rising demand in China and India.

Latin America & Middle East & Africa:

Sprouting interest in luxury mobility and fleet deployment projects, though at a slower adoption pace.

COVID‑19 Impact Analysis

The pandemic initially disrupted supply chains and delayed implementation in newer vehicle models. However, recovery was swift—supported by rising demand for in-cabin personalization and contactless user experiences. Smart cabin technologies including active window displays gained momentum in electric and premium vehicles.

Commutator Analysis

Active window displays operate via electronic architecture:

- Display Substrate Technology: Transparent OLED/LED prints and electrochromic glass layers

- Touch & Interaction Sensors: Embedded capacitive layers for gesture control

- Smart Tint Modules: Dynamic opacity control for privacy and glare reduction

- Display Control Systems: Integrated with vehicle CAN, power supply, and overlay software

- Haptic & Illumination Features: Optional audio/visual feedback for touch experience

Key Questions Answered

- What is the expected value by 2030?

USD 4.2 Billion - What is the projected CAGR?

Around 11.5% between 2024 and 2030 - Which display technologies lead?

Transparent OLED and smart glass are leading, with LED matrix adoption increasing. - Which vehicle segments are driving demand?

Luxury and EV segments, followed by passenger mobility fleets. - Which regions drive growth?

North America leads; Asia-Pacific is growing fastest. - How did COVID‑19 influence the market?

Early setbacks reversed by demand for smart cabin enhancements and fleet applications. - What future trends should we watch?

Gesture-based interaction, energy-efficient substrates, AR/windshield overlays, and fleet-specific brand/comfort use cases.

Conclusion

The automotive active window display market is on the fast track to USD 4.2 billion by 2030. As connected mobility and passenger experience demands grow—especially in luxury, EV, and autonomous vehicle markets—active and interactive window systems will be key interface elements. Manufacturers and suppliers focusing on energy efficiency, transparency, and haptic interaction will be well-positioned for leadership in this emerging vehicle technology space.

About Maximize Market Research

Maximize Market Research Pvt. Ltd. is a global market research and consulting company headquartered in Pune, India. The firm specializes in data-driven insights across industries such as automotive, healthcare, electronics, and technology. Its team provides custom reports and strategic recommendations to support business growth and market entry.

Contact Us

Maximize Market Research Pvt. Ltd.

2nd Floor, Navale IT Park, Phase 3

Pune-Bangalore Highway, Narhe

Pune, Maharashtra 411041, India

📞 +91 96073 65656

✉️ sales@maximizemarketresearch.com