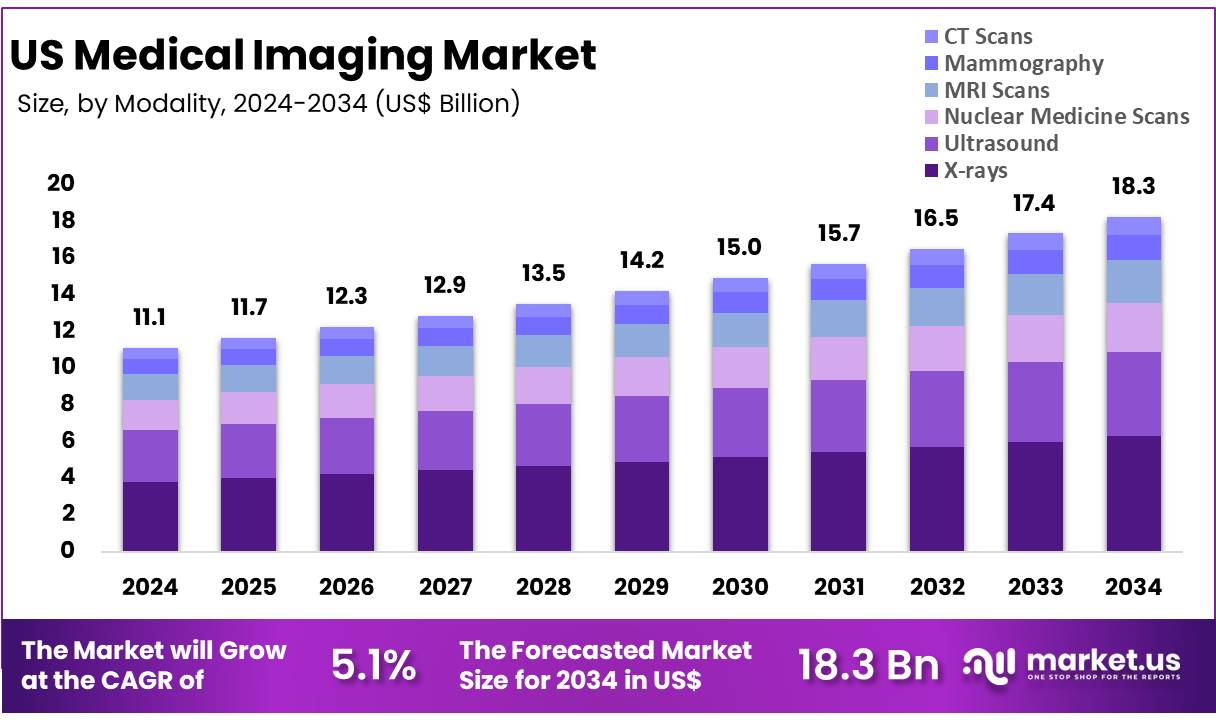

The US Medical Imaging Market size is expected to be worth around US$ 18.3 Billion by 2034 from US$ 11.1 Billion in 2024, growing at a CAGR of 5.1% during the forecast period 2025 to 2034.

The U.S. Medical Imaging Market is entering a high‑precision era in 2025, fueled by next-generation modalities such as digital breast tomosynthesis, spectral CT, and personalized contrast-enhanced MRI. Imaging networks are upgrading systems to support personalized protocols—such as low-dose CT scans for young patients or tailored cardiac imaging for women. Molecular and functional imaging techniques are integrated into oncology workflows, enabling early therapeutic response assessments.

Combined with AI-guided acquisition, these advancements are enhancing diagnostic clarity while minimizing patient exposure. Hospitals report more accurate treatment planning and optimized biopsy guidance. With precision imaging becoming mainstream, U.S. providers are setting new standards in personalized radiology care.

Click here for more information: https://market.us/report/us-medical-imaging-market/

Key Market Segments

By Modality

- X-rays

- Ultrasound

- Nuclear medicine scans

- MRI scans

- Mammography

- CT scans

By End-use

- Hospitals

- Diagnostic imaging centers

- Others

Emerging Trends

- Widespread adoption of tomosynthesis for earlier and clearer breast cancer detection.

- Spectral CT scanners enhancing tissue differentiation in cardiac and liver imaging.

- Low-dose CT protocols tailored by patient demographics and indication.

- Fusion of molecular PET/MR imaging for real-time oncology monitoring.

Use Cases

- A breast center switches to 3D tomosynthesis, reducing call-back rates by 20%.

- A cardiology practice uses spectral CT to improve plaque characterization in vascular patients.

- Pediatric hospitals implement customized low-dose CT workflows to limit radiation exposure.

- An oncology team monitors tumor response via PET/MRI fusion during chemotherapy cycles.