Flue Gas Desulfurization (FGD) Systems Market Set to Reach USD 34.1 Billion by 2032, Driven by Emission Norms and Industrial Growth

Market Size

- 2024 Estimated Value: USD 22.46 Billion

- 2025 Projection: USD 23.34 Billion

- 2032 Forecast: USD 34.1 Billion

- CAGR: Ranges from approximately 3.9% to 6.3%

Overview

Flue Gas Desulfurization (FGD) systems are critical emission control technologies that eliminate sulfur dioxide (SO₂) from exhaust gases in industrial processes, especially in coal-fired power plants. These systems help industries comply with environmental regulations, improve air quality, and generate by-products like gypsum used in construction. With rising industrialization and stringent environmental policies, demand for both wet and dry FGD technologies is growing rapidly across power generation, cement, chemical, metal, and mining sectors.

To Know More About This Report Request A Free Sample Copy https://www.maximizemarketresearch.com/request-sample/45109/

Market Growth Drivers & Opportunities

Key Drivers

- Stringent Environmental Regulations

Government mandates across regions enforce limits on SO₂ emissions, driving large-scale adoption of FGD systems, especially in coal-reliant economies. - Industrial Expansion

Rapid growth in energy, metallurgy, cement, and chemical sectors increases demand for efficient emission control systems. - Retrofitting of Existing Power Plants

Older coal-based plants are increasingly being retrofitted with FGD systems to meet evolving emission standards. - By-product Revenue Generation

Wet FGD systems produce gypsum, which can be commercially utilized in cement and wallboard manufacturing, creating economic incentives.

Opportunities

- Expansion in non-power sectors such as cement and industrial manufacturing

- Growing demand in emerging economies such as India, Brazil, and Southeast Asia

- Technological advancements in hybrid and multi-pollutant scrubbing systems

- Use of digital monitoring and automation for system optimization

Restraints

- High capital investment and maintenance costs

- Energy-intensive operation resulting in slight reduction in overall plant efficiency

- Transition to renewable energy sources reducing coal plant expansion in some regions

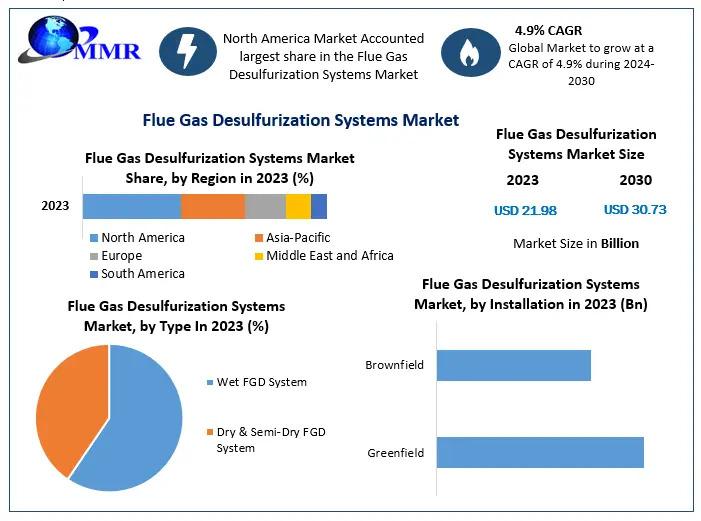

Segmentation Analysis

By Technology

- Wet FGD Systems: Most widely adopted; offer >95% removal efficiency of SO₂; suitable for large-scale, continuous operations.

- Dry & Semi-Dry FGD Systems: Suitable for smaller plants and regions with limited water availability; offer moderate efficiency.

- Spray-Dry Systems: Typically used in municipal or low-to-medium scale industrial plants.

By End-User Industry

- Power Generation: Dominates the market with widespread use in coal-fired power stations.

- Chemical Industry: Uses FGD for treating acidic flue emissions.

- Cement & Metallurgical Plants: Increasing integration due to stricter environmental norms.

By Installation Type

- Greenfield Installations: New plants with integrated FGD from inception.

- Brownfield Installations: Retrofitting older facilities with modern FGD systems.

Major Manufacturers

- Andritz AG

- Babcock & Wilcox Enterprises

- Chiyoda Corporation

- General Electric

- Mitsubishi Hitachi Power Systems

- Doosan Lentjes

- Thermax Limited

- Fujian Longking

- Hamon Corporation

- Rafako SA

- ISGEC Heavy Engineering

- Steinmüller Engineering

- Carmeuse Group

- Lodge Cottrell

- Kawasaki Heavy Industries

These companies are focusing on global expansion, innovation in scrubber technologies, and partnerships with government agencies for emission control compliance.

Get More Info: https://www.maximizemarketresearch.com/request-sample/45109/

Regional Analysis

Asia-Pacific

Leads the global market with the highest share, driven by strong coal-based power generation in China, India, and Southeast Asia. Significant investments in FGD installations are seen in both new and existing plants.

North America

Holds substantial market share due to environmental regulations enforced by agencies such as the EPA. The U.S. continues to modernize older coal power plants with wet and dry scrubber systems.

Europe

Driven by aggressive climate policies, nations such as Germany, the UK, and Poland are implementing large-scale FGD systems. Demand also comes from the chemical and metallurgy industries.

Latin America and Middle East & Africa

Experiencing moderate growth as energy infrastructure is modernized. Countries with oil-fired and coal-powered plants are gradually incorporating FGD technologies.

COVID-19 Impact Analysis

The COVID-19 pandemic temporarily disrupted manufacturing, plant operations, and new installations. However, post-pandemic recovery has brought renewed focus on sustainable industrial practices. Governments and industries have accelerated investments in emission control systems, resulting in a rebound in demand for FGD systems since 2021.

Commutator Analysis

FGD systems consist of several major components and technologies working together to ensure high SO₂ removal efficiency:

- Absorber or Scrubber Units: Key components where flue gases react with sorbents like limestone or lime slurry to neutralize sulfur content.

- Re-heaters & Pumps: Maintain optimal temperature and pressure for chemical reactions.

- Mist Eliminators: Prevent droplet carry-over and ensure clean gas emissions.

- Slurry Preparation Units: Prepare and manage the sorbent mixtures.

- Gypsum Dewatering & Handling Units: Convert wet by-products into usable gypsum.

- Automation & Instrumentation: Enable precise control and monitoring through sensors, PLCs, and SCADA systems.

Integration of these components allows for continuous operation, minimal maintenance, and high reliability under varied industrial conditions.

Key Questions Answered

- What is the projected value of the FGD systems market by 2032?

The market is forecast to reach USD 34.1 Billion by 2032. - Which technology dominates the market?

Wet FGD systems currently dominate due to their superior removal efficiency and gypsum by-product potential. - What are the key drivers of market growth?

Regulatory pressure, industrial expansion, coal-based power generation, and by-product utilization are major growth factors. - Which regions are leading the global market?

Asia-Pacific holds the largest market share, followed by North America and Europe. - What challenges does the market face?

High setup and operational costs, along with reduced adoption in regions transitioning to renewable energy, are notable barriers.

Conclusion

The global Flue Gas Desulfurization Systems Market is undergoing significant growth due to rising environmental concerns, regulatory mandates, and industrial modernization. With an expected market size of USD 34.1 Billion by 2032, FGD systems will continue to be integral to sustainable industrial processes. Technological advancements in scrubbers, automation, and hybrid systems will further enhance their adoption across diverse sectors. Emerging economies present untapped opportunities for new installations and retrofits, making this market a cornerstone of the global clean air and environmental compliance strategy.

About Maximize Market Research:

Maximize Market Research is a global market research and consulting company specializing in data-driven insights and strategic analysis. With a team of experienced analysts and industry experts, the company provides comprehensive reports across various sectors, aiding businesses in making informed decisions and achieving sustainable growth.

Contact Us

Maximize Market Research Pvt. Ltd.

2nd Floor, Navale IT Park, Phase 3

Pune-Bangalore Highway, Narhe

Pune, Maharashtra 411041, India

📞 +91 96073 65656

✉️ sales@maximizemarketresearch.com